Carmen Is Planning to Invest 200 in a Retirement Account

Investment advisory and trust services are offered through Northwestern Mutual Wealth Management Company NMWMC Milwaukee WI a subsidiary of NM and a federal savings bank. He used the following formula and variables to solve for the future value of the account after 5 years.

Solved X 5 Earl Opens A Savings Account With 5 000 He Deposits 1500 Each Year Into The Account That Compounds Quarterly And Has A 0 65 Interes Course Hero

The account is earning 315 interest compounded annually.

. You will need to make annual payments of 1 comma 100 at the end of each year. The account is earning 315 interest compounded annually. The maximum amount you can contribute to a Roth 401 k for 2022 is 20500 if youre younger than age 50.

Carmen is planning to invest 2000 in an account earning 315 interest compounded quarterly for 5 years. We want to calculate the amount of money you will receive from this investment that is we want to find the future value FV of your investment. He used the following formula and variables to solve for the future value of the account after 5 years.

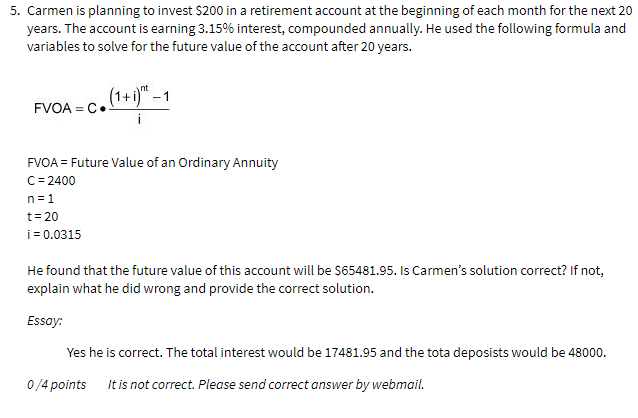

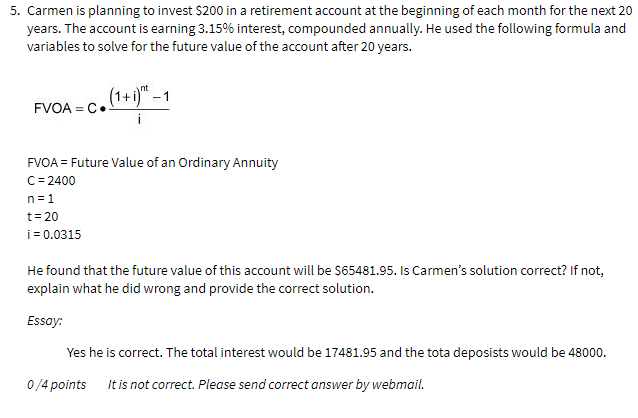

Carmen is planning to invest 200 in a retirement account at the beginning of each month for the next 20 years. The effective annual return of the stock account is expected to be 11 percent and the bond account will earn 7 percent. There is over 76 trillion invested in IRA accounts.

You plan to deposit 300 in a bank account now and 400 at the end of the year. Ambergris Caye is not one of the worlds cheapest places to retire. To save for retirement you will invest 1800 per month in a stock account in real dollars and 605 per month in a bond account in real dollars.

He used the following formula and variables to solve for the future value of the account after 20 years. Document the arrays using a chart with columns titled. Show the timeline of the loan from your perspective.

A person has deposited 3000 in the retirement account today. So after 40 years amount will be compounded to-3000 1075 403000times 18044238975413272 If it is kept invested for 45 years instead of 40 years then the amount will be-3000 1075 453000times 25904838637771452. Carmen is planning to invest 200 in a retirement account at the end of each month for the next 20 years.

You are planning to invest 2000 in an account earning 10 per year for retirement. You are planning to save for retirement over the next 30 years. Here we have 200 invested at the very beginning so we must ADD 200 plus the interest it will accrue for the whole 30 years that will be C1in 20010025360 but NO 200 is invested at the very end SO we must subtract C 200 at the end.

Carmen is planning to invest 200 in a retirement account at the beginning of each month for the next 20 years. Roughly 47 of the funds are held in mutual funds while the amount held in alternative assets such as foreign real estate is thought to be less than 2 of all IRA assets. How Our Retirement Calculator Works.

Carmen is planning to invest 2000 in an account earning 315 interest compounded quarterly for 5 years. The account is The account is Q. To count it we need to plug in the appropriate numbers into the compound interest formula.

Carmen is planning to invest 200 in a retirement account at the end of each month for the next 20 years. It will carry 75 interet. This is an extra 1000 over.

Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by your post-retirement years. Ad Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. FV PV1 int.

Evaluate Funds and Performance Open an IRA Save for Retirement. Products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial advisors and professionals. You plan to put down 1 comma 600 and borrow 4 comma 600.

The ring costs 6 comma 200. FV PV1 int FV Future Value PV 2000 i 3154 n 4 t 5 He found that the future value of this account will be 22179461884. Individuals are encouraged to consult their tax and legal advisors a before establishing a retirement plan or account and b regarding any potential tax ERISA and related consequences of any investments made under such plan or account.

If you put the 2000 in an account at age 23 and withdraw it 41 years later how much will you have. 2 annual salary increase pre-retirement Cost-of-living is 70 of your annual pre-retirement salary. FV 10000 1 0051 101 10000 1628895 1628895.

He found that the future value of this account will be 6548195. The acco The acco Q. Generally the cost of investing has gone down in 401k plans.

Carmen is planning to invest 2000 in an account earning 315 interest compounded quarterly for 5 years. Outer loop inner loop i j and x. You could buy a two-bedroom two-bath.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. FV PV 1 int FV Future Value PV 2000 i 3154 n 4 t 5 He found that the future value of this account will be 22179461884. Jerry starts to save at age 35 for a vacation home that he wants to buy for his 50th birthday.

The average expense ratio for an equity mutual fund in a retirement plan was 039 in 2019 compared to 077 in 2000 according to. He used the following formula and variables to solve for the future value of the account after 5 years. 5 Investors should consider many factors before deciding which 529 plan is appropriate.

Our calculator makes the following assumptions. If you wait 10 years before making the deposit so that it stays in the account for only 31 years how much will you have at the end. Opportunities exist for account holders to utilize retirement account funds for alternative investments.

A reasonable budget for two would be 3000 per month including 800 to 1000 for rent.

Solved Carmen Is Planning To Invest 200 In A Retirement Account At The Course Hero

Solved X 5 Earl Opens A Savings Account With 5 000 He Deposits 1500 Each Year Into The Account That Compounds Quarterly And Has A 0 65 Interes Course Hero

Solved Super Urgent Future Value Of An Ordinary Annuity Chegg Com

0 Response to "Carmen Is Planning to Invest 200 in a Retirement Account"

Post a Comment